March 1, 2013, - 1:31 pm

Obamaconomy: Nearly Half of All US Home Sales Are Foreclosures & Short Sales

On this site, I’ve told you about the Obama Dollar Store Cold Turkey Index, the Obama Diaper Rash Index, the Obama Spam Consumption Index, and the Obama Lego Toy Market Index–all basic daily life indicators of how bad things are in America under the hegemony of Barack Hussein Obama. Now there is the Obama Distressed Home Sales Index. Nearly half of all homes sold in the United States in 2012 were from foreclosures and short sales.

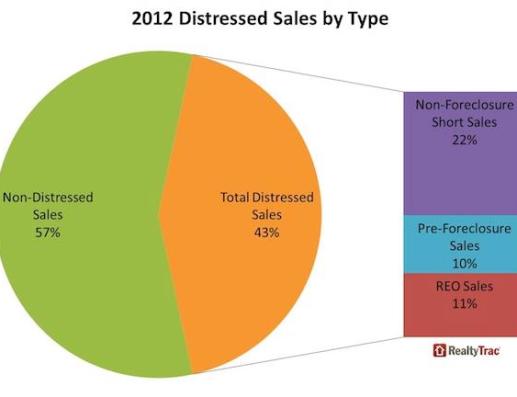

Close to half of all home sales last year were in some way related to foreclosed properties or short sales, a figure still disproportionately high. . . . A total of 947,995 U.S. properties in some stage of foreclosure or bank-owned (REO) were sold during the year . . . . reported RealtyTrac today. Foreclosure-related sales and “short sales,” when homes are sold for less than what is owed, accounted for a combined 43 percent of all U.S. residential sales in 2012.

A total of 947,995 U.S. properties in some stage of foreclosure, or bank-owned (REO), were sold during the year, a decrease of 6 percent from 2011 and down 11 percent from 2010. These foreclosure-related sales accounted for 21 percent of all U.S. residential sales during the year. . . .

Properties not in foreclosure that sold as short sales in 2012 accounted for an estimated 22 percent of all residential sales — bringing the total share of distressed sales to 43 percent, including both foreclosure-related sales and non-foreclosure short sales. In the fourth quarter of 2012, residential properties in foreclosure or bank-owned sold for an average price of $171,704, an increase of 2 percent from the third quarter and an increase of 4 percent from the fourth quarter of 2011.

“Although foreclosure-related sales represent a shrinking share of total sales, primarily because of fewer bank-owned purchases, distressed sales are still a disproportionately high portion of the overall housing market,” said Daren Blomquist, vice president of RealtyTrac. . . .

Properties not in foreclosure that sold as short sales in 2012 accounted for an estimated 22 percent of all residential sales — bringing the total share of distressed sales to 43 percent including both foreclosure-related sales and non-foreclosure short sales.

Other findings from RealtyTrac’s year-end report:

* U.S. pre-foreclosure sales in 2012 increased 6 percent from the previous year, while sales of bank-owned homes (REO) decreased 15 percent.

* Pre-foreclosure sales in 2012 increased from the previous year in 28 states and outnumbered REO sales in 12 states, including Arizona, California, Colorado, Florida, Maryland, New Jersey and New York.

* Despite the decrease nationwide, REO sales in 2012 increased from the previous year in 26 states and still outnumbered pre-foreclosure sales in 38 states, including Georgia, Illinois, Indiana, Massachusetts, Michigan, Minnesota and Nevada. . . .

* Non-foreclosure short sales accelerated toward the end of the year, with the fourth quarter total the highest quarterly total of the year and up 17 percent from the fourth quarter of 2011.

[Emphasis added.]

What are the worst areas of the country in terms of foreclosure-related home sales, according to the study?

Foreclosure-related sales accounted for 46 percent of all residential sales in the Riverside-San Bernardino-Ontario metro area in Southern California in 2012, the highest percentage among the nation’s 20 largest metropolitan statistical areas in terms of population.

Other metros where foreclosure-related sales accounted for at least 30 percent of all residential sales in 2012 were Atlanta (41 percent), Los Angeles (36 percent), Phoenix (34 percent), San Diego (34 percent), Detroit (32 percent), San Francisco (31 percent) and Chicago (31 percent).

Barack Obama “at work” (or at the ninth hole).

Tags: Barack Obama, Barack Obama Distressed Homes, Barack Obama Foreclosures, Detroit, Distressed Home Sales, Obama Foreclosed Homes, Obamaconomy

SHIMON PERES ,PRESIDENTE ESTADISTA ISRAELI .REVELO QUE LOS ESTADOS UNIDOS NO PERMITIRA QUE IRAN TENGA ARMAS NUCLEARES,POR SU PARTE,WENDY SHERMAN DECALRO QUE EE,UU ,NOTIENE OTRO AMIGO MAS CERCANO QUE ISRAEL.

Shimon Peres, presidente de Israel, reveló que los Estados Unidos no permitirá que Teherán obtenga armas nucleares.

Formuló estas declaraciones tras mantener una reunión con la vicesecretaria del Departamento de Estado de EE.UU., Wendy Sherman.

Según Peres, Sherman, que ha representado a EE.UU. en las negociaciones sobre el programa nuclear de Irán en Kazajistán, confirmó los planes del mandatario estadounidense, Barack Obama, de no permitir que Irán obtenga armas nucleares.

Por su parte, Wendy Sherman declaró que EE.UU. no tiene otro amigo más cercano que Israel.

El Gobierno de Teherán planea construir 16 nuevas centrales nucleares, anunció la Organización de Energía Atómica de Irán (OEAI), según la televisión oficial iraní en inglés, PressTV.

La agencia nuclear iraní explicó también que, desde que se descubrieron yacimientos de uranio en el país en 1977, las reservas probadas de material extraíble de este mineral en Irán se han multiplicado hasta alcanzar las 4.400 toneladas en los últimos meses.

Los inspectores de la agencia nuclear de la ONU ha contabilizado en Natanz 180 centrifugadoras o armazones de centrifugadoras del avanzado tipo IR-2m, detalla el documento, al que tuvo acceso Efe.

Estas máquinas son entre tres y seis veces más rápidas que las unidades IR1, usadas hasta ahora por Irán y con las que ha enriquecido ya unas 9 toneladas de uranio.

La continuada instalación de centrifugadoras y su modernización contravienen las exigencias del Consejo de Seguridad de la ONU, que pide un cese completo del enriquecimiento como medida para crear confianza.

Según datos difundidos en Viena por el Organismo Internacional de la Energía Atómica (OIEA), Irán ha enriquecido hasta ahora 8.271 kilos de uranio de hasta el 5 por ciento de pureza y 280 kilos de uranio de hasta el 20 por ciento.

En el último mes, tanto el OIEA como el OEAI han informado de que Irán ha intensificado sus trabajos de enriquecimiento de uranio con la instalación de nuevas y más rápidas centrifugadoras.

Irán está sometido a sanciones del Consejo de Seguridad de la ONU, y también de la UE, EE.UU. y otros países, por su programa nuclear, que algunos gobiernos, con el de Washington a la cabeza, sospechan que podría tener una vertiente armamentista, lo que Teherán niega y afirma que es exclusivamente civil y pacífico.

Occidente -con Estados Unidos, la Unión Europea e Israel a la cabeza- temen que Irán quiera usar un supuesto programa nuclear civil para fines militares.

Por eso, EEUU y especialmente Israel no descartan atacar Irán para destruir sus capacidades nucleares.

Los inspectores del OIEA exigen desde hace un año acceder a la base militar de Parchin, cerca de Teherán, donde los servicios de inteligencia occidentales sospechan de actividades clandestina relacionadas con el programa nuclear iraní.

ABEL REYES TELLEZ

PRESIDENTE NACIONAL

PARTIDO SOCIAL CRISTIANO

NICARAGUENSE {PSC}

ESCRITOR CRISTIANO

EMAIL .PRESIDENTE.PSC@HOTMAIL.COM

TEL .505. 2249 3460

MOVIL .505 .8882 7758

MANAGUA NICARAGUA

ABEL REYES TELLEZ on March 1, 2013 at 1:47 pm