November 24, 2008, - 11:44 am

Schadenfreude Photo of the Day: The Pic That Warms My Heart

By Debbie Schlussel

This picture, below, warms the cockles of my heart. It’s the very definition of schadenfreude. If only our markets and economy weren’t involved and entangled in the downward spiral. And if only they didn’t own so much of our country. Maybe this is the time they sell some of it off and westerners with western values (like, oh, um . . . Americans) buy it at bargain basement prices. Sadly, Prince Alwaleed Bin Talal doesn’t seem to be doing that.

More:

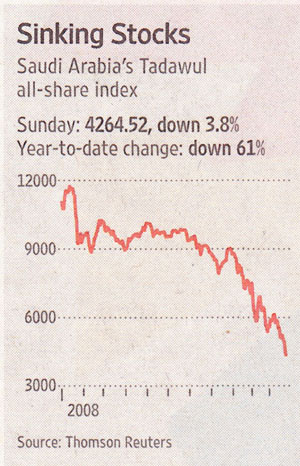

The country’s stock market has fallen sharply along with those of the rest of the world. But the drop on the Saudi stock market — the biggest by value in the Gulf — has been particularly steep. On Sunday, the market’s main index fell 3.8%, shrugging off the central bank’s moves and extending a 9.2% drop Saturday. The index is down more than 61% year-to-date.

A Saudi trader at the Saudi Bank in Riyadh on Saturday, when the country’s main stock-market index dived 9.2%. The index fell an additional 3.8% Sunday despite the Saudi central bank’s easing of monetary policy.

Falling oil prices have helped sour investors’ sentiment. U.S. benchmark crude fell below $50 a barrel last week, from highs above $140 a barrel in July. The International Monetary Fund estimated that the average Gulf oil-producing country’s “break-even” price — the price such countries need to keep from running fiscal deficits — is $47 a barrel. (Many Gulf crudes trade at a discount to U.S. blends.)

Falling crude already has sent some government officials scrambling to review budgets and the economics of big infrastructure projects. Iraqi finance officials have cut their proposed budget for next year because of the big drop. Saudi officials have put on review a number of projects, including a big aluminum project. . . .

In an email last week, Aramco told companies bidding for $1.2 billion of projects related to an onshore oil field that the company had canceled the work, according to Zawya Dow Jones. Aramco didn’t respond to requests for comment.

Falling oil prices and the global financial crisis have dramatically changed the landscape for policy makers in Saudi Arabia and the rest of the Gulf. Just a few months ago, officials here were fretting about the prospect of runaway regional inflation.

So sad, too bad. Remember when they told us “$2 a gallon gas–we’ll never see that again; those days are gone forever”?

Silver lining to every Al-Cloud, Habibi.

BTW, look at this photo of a trader at Saudi Bank, which accompanied the story. What do you think is the deal with the person at left? I say it’s a woman, who had to be “modestified” for the cameras, lest her ugly Wahhabi mug turn on some photog. Uh-oh, her feet are exposed. Might give someone an orgasm.

LOL … I’m more interested in her Wahhabis rather than having some foot fetish … but as we always say: “Oils well that ends well!”

Jimmy Lewis

SCS, Michigan

Blog: http://rougerevival.blogspot.com/

Jimmy on November 24, 2008 at 12:06 pm