October 22, 2008, - 1:30 pm

Who is Cathy Shaughnessy?: Dem Far-Left Candidate’s Bankruptcy Fraud Shows Blogs’ Importance; End of MSM Investigative Journalism; Embodies Mortgage Bailout BS; UPDATE: Mortgage Fraud, Too?

By Debbie Schlussel

The story of Cathy Shaughnessy is important on many fronts. This far-left Democratic candidate for office demonstrates why blogs are important because some of them–like this one–actually do the investigative journalism the mainstream media won’t. Shaughnessy is also Exhibit A of the kind of lowlife the mortgage bailout bill will help via your hard-earned tax money. And how far left liberals can often get away with murder. Or, at least, apparent bankruptcy fraud and/or campaign finance fraud.

Catherine Caya Shaughnessy is an unbalanced, liberal, part-time yoga teacher and Democratic Party candidate for Township Clerk in swanky, upscale Detroit suburb of West Bloomfield Township.

If elected in November–and she will be, because Republicans chose to consort with her and not to put up an opponent–Shaughnessy stands to earn over $106,000 in annual salary and $40,000-plus in benefits.

Problem is, in addition to her mental instability, it appears that Cathy Shaughnessy committed bankruptcy fraud in U.S. Bankruptcy Court.

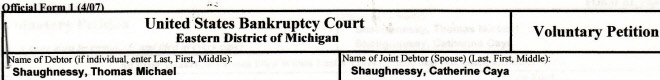

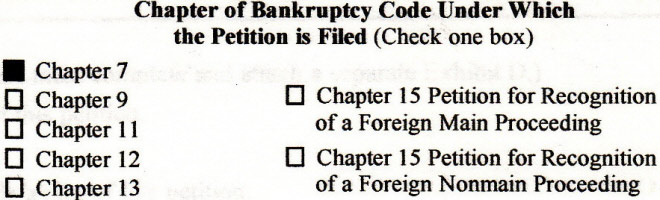

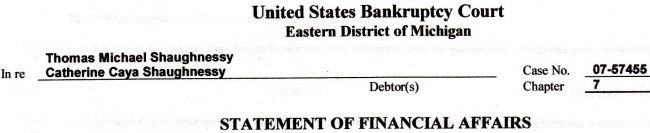

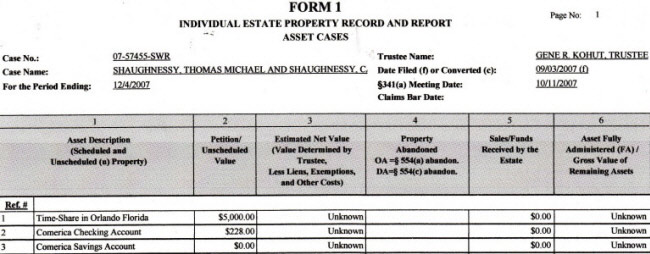

Shaughnessy and her husband Tom filed for Chapter 7 bankruptcy last year in U.S. Bankruptcy Court in Michigan–Case No, 07-57455–and their bankruptcy continues. The case is not yet closed.

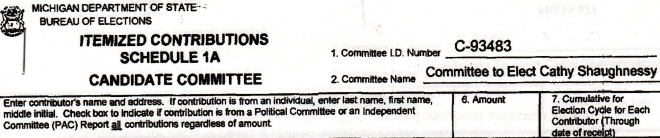

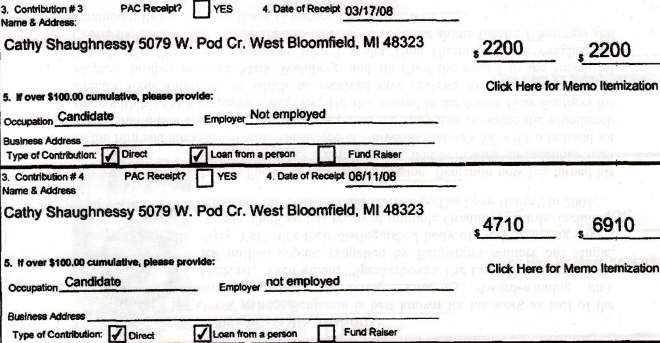

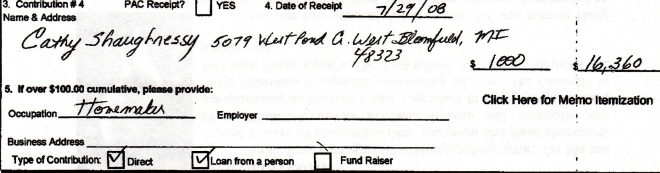

She and her husband claimed they couldn’t pay their bills, including the $450,474 they owe to AMC Mortgage Services, while at the same time Shaughnessy donated over $16,000 to her campaign for office, money which she apparently concealed and secreted from her bankruptcy filing. Court filings don’t show any report by Shaughnessy to the Bankruptcy Trustee of the possession and/or receipt of these funds.

That’s generally called “bankruptcy fraud”, and it’s usually followed by fines of up to $500,000 and/or imprisonment for up to five years.

Chapter 7 bankruptcy means you have assets and earnings at or below the level of poverty and cannot pay your creditors back. You get to wipe the slate clean and avoid most obligations.

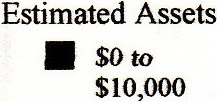

Cathy Shaughnessy and her husband claimed in bankruptcy filings that their only funds were $228.00 in a checking account and ZERO in savings. They also claimed that they had assets of only $0-$10,000. Yet, beginning in March, Ms. Shaughnessy began loaning a total of $16,360 to her campaign.

Where did she get the money? And why wasn’t it listed in her bankruptcy filings and used to pay money to the many creditors she owed? In her campaign filings, Shaughnessy lists her “employment” as “Homemaker”, so clearly she had no way of earning the mysterious money. Her bankruptcy filing also notes that she is not a wage earner.

And while her bankruptcy filing lists total household income of $24,609 in 2005, $13,159 in 2006, and $59,672 in 2007, Shaughnessy also lists monthly living expenses at $5,127. So how did she suddenly have over $16,000 to lend her campaign, unless she committed bankruptcy fraud, campaign finance fraud, or both? If the money was lent to or given to her by someone else, then that likely constitutes money laundering and campaign finance fraud, something for which attorney Geoffrey Fieger was prosecuted in federal court.

And the bankruptcy filing isn’t the only apparent lie. During her primary campaign, Shaughnessy sent out a letter to West Bloomfield Township voters, claiming that her bankruptcy was due to the failure of the automotive industry and that before that her husband’s defunct business was “thriving.”

But Shaughnessy’s bankruptcy filing tells a different story. She and her husband Tom list about $700,000 in unpaid debts, including tens of thousands of dollars in multiple credit card debts spanning almost three decades and dating back to 1980.

Yet, at the same time, while she and her husband did not pay their obligations, they owned a time share in Florida, a boat, and an expensive home in one of Michigan’s most upscale suburbs. It’s also well-known that their daughter was involved in very expensive dance lessons and competitions. They lived the high life. They owe almost $50,000 EACH to American Express and MBNA America for credit card bills, $5,300 in 2003 income taxes to the IRS, and $2,000 on a Macy’s department store charge card, to name a few of their many debts completely blown off while Cathy Shaughnessy gave thousands to her own campaign for office.

This is how Cathy Shaughnessy managed her own, um, “budget”. Imagine how she will spend the taxpayers’ money as Clerk.

Shaughnessy and her husband Tom had their home in swanky West Bloomfield foreclosed on, but they are the typical beneficiaries of the mortgage bailout bail. While you pay your federal income taxes, they lived the high life and didn’t pay theirs. While you will pay for bailouts of irresponsible homeowners like them, she’s spending thousands on her campaign for office . . . thousands that she didn’t bother to declare to Federal Bankruptcy Court.

Both Shaughnessy’s and her husband’s signatures are all over bankruptcy filings declaring that they are telling the truth under severe penalty of law. But apparently, they think they can get away with it. And because of the failure of Detroit’s mainstream media outlets to cover this very blatant, egregious behavior, they are, indeed, getting away with it.

And you are paying the price. You will pay for the increased prices for the items they bought and chose not to pay for. I can understand and feel for anyone who is stuck in unexpected hard times in a tough national and even tougher Michigan economy.

But that’s not the case here. Most people who file for Chapter Seven Bankruptcy are legitimately down on their luck with no assets and barely able to survive. On the contrary, Cathy Shaughnessy suddenly had–as a homemaker with no income–over $16,000 to lend to her campaign.

Moreover, the Shaughnessys lived their entire marriage in debt, all the time living the high life while their creditors were holding the bag. They bought an expensive home in one of Detroit’s wealthiest suburbs, spent thousands on clothes and vacation destinations, and other excesses for their luxe life. At the same time, Shaughnessy did not work to pay off her debts and stayed at home while teaching a yoga class here and there.

Oh, and she spent her other free time as an environmental extremist, trying to prevent people from building or expanding their homes and businesses, as a member of the West Bloomfield Township Board’s Wetland Commission.

In 2006, Shaughnessy’s outlandish and lunatic behavior and rudeness were the reasons Township Board Trustees removed her from the commission. The language used was:

APPROVED removal of Catherine Shaughnessy from the Wetland Review Board for reasons of insubordination to the Township Board, inappropriate behavior to fellow board members, petitioners, public and Township professionals.

I’ve been a target of the crazy Shaughnessy’s nutjob antics. Although I don’t know her, in 1998 I was campaigning outside a polling place when I was running for the Michigan House of Representatives. Shaughnessy was campaigning for her fellow liberal Democrat–my pro-choice, incompetent trial lawyer opponent Marc Shulman–who was posing as a Republican in what was then a Republican-dominated district. As I stood there trying to hand out my campaign literature to voters, Shaughnessy yelled loudly to her then eight-year-old daughter (and voters),

You see that C-nt, Debbie Schlussel. She’s a F-cking Cunt and a B-tch.

This and other hysterically screamed obscenities and abuse from Catherine Shaughnessy went on for hours, outside a community center where people took their kids for after school classes and activities. It was so offensive that the police had to be called by passers-by, who unlike Cathy Shaughnessy, didn’t want their young kids to hear this stuff.

But the ultimate chutzpah is not Cathy Shaughnessy’s unhinged, wacko behavior. It’s her own donation of thousands to her campaign at the same time that her Chapter Seven bankruptcy is ongoing. A March 31, 2008 asset and property report filed in her bankruptcy showed only $228.00 in a checking account and ZERO in savings, while two weeks earlier, on March 17, 2008, Shaughnessy lent $2,200 to her campaign, the first of thousands of dollars she would loan herself.

Not exactly the kind of integrity-endowed person with whom you want to entrust your election ballots, which is what she’ll be overseeing and “counting” for the next four years. Don’t bet that she’ll be able to count ballots more accurately than she counts her own money in bankruptcy filings.

By the way, this summer, while Cathy Shaughnessy was loaning her campaign thousands of dollars, the Federal Bankruptcy Trustee in the case was forced to reduce his fees from almost $2,000 to about $300, because according to her bankruptcy, she didn’t have the money to pay. Indeed.

This story should be all over the Detroit newspapers and television news, but it isn’t. If Shaughnessy were an arch-conservative or even a centrist instead of a far-left loon with obvious mental health issues, it would dominate the headlines.

Instead, those much derided blogs and bloggers–like this site and me–must do the work (investigative journalism) that some Americans (the mainstream media) just won’t do.

***

Predictably, Cathy Shaughnessy did not respond to questions regarding her apparent fraud. Someone who didn’t do anything wrong would have responded and defended herself, but she did not answer this e-mail:

From: Debbie Schlussel writedebbie@gmail.com

Date: Mon, Oct 20, 2008 at 4:50 PM

Subject: CATHY, PRESS Inquiry . . .

To: Cathy Shaughnessy

Hi, Cathy:

I have a few questions for a piece I’m writing:

You filed for bankruptcy, stating you had assets of $10,000 or less. Yet, while in bankruptcy, you suddenly had $16,000 to loan to your campaign. Where did the money come from, since you note that you are a homemaker and not employed–on your campaign forms? Also, did you report the $16,000 to the bankruptcy trustee and creditors in your case? How did you have $16,000 to give to your campaign, while the bankruptcy trustee had to waive most of his fees b/c you allegedly didn’t have the money?

Please let me know the answers to these questions because I am writing about it and I want to give your side, too.

Debbie Schlussel

***

Will Cathy Shaughnessy be prosecuted for bankruptcy fraud by the Republican-dominated U.S. Attorney’s office?

Don’t hold your breath.

The Republicans chose not to even put up a candidate against her, insuring that she will sail into office in November. And the nutty Shaughnessy, sadly, has big government Republican supporters behind the puppet strings. Sharon Law, the Republican clerk she will be replacing, her husband, Republican officeholder Tom, and son, Republican officeholder David Law (a State Representative running for my county’s prosecutor and who will probably win), are all backing this lunatic.

The Laws–career Republican politicians on the taxpayer dole–donated hundreds to Shaughnessy’s campaign, out of anger against the Township, after Sharon Law cost the Township hundreds of thousands in tax money. The Township had to settle a defamation lawsuit for about $200,000 after Sharon Law defamed a person using Township e-mail, cost the person her job, and perjured herself on the stand in federal court.

Yes, clearly there’s precedent for corruption in this Detroit suburb’s Clerk position.

It’s a great story, if only the Detroit media would bother to cover it. But their refusal to do so is why both the Detroit Newsistan and Free Press must layoff workers and are losing money, while this website’s readership continues to grow.

**** UPDATE, 10/23/08: Did Far-Left Democratic candidate Cathy Shaughnessy commit Mortgage Fraud? Reader David, who is a mortgage lender, writes that it appears that Cathy Shaughnessy took out a “Liar’s Loan” mortgage:

I notice that on your article dealing with Shaughnessy that the mortgage has a balance of $450,000.00, which in itself does not fit. Their [Cathy and Thomas Shaughnessy’s] incomes do not support the balance of that loan.

Then, I noticed that their mortgage is with AMC as a mortgage holder. AMC took over portfolios for a lot of the subprime lenders, i.e. Indymac. The loans that AMC took over were almost only “Stated Income/Stated Asset” loans, what many are now calling “Liars Loans”. It would be interesting to see the “Stated Income” that Shaughnessy “quoted” in order to get her loan, and if she committed fraud to do it.

This “Stated Income” would possibly be of interest to both the mortgage lender that granted the loan and the bankruptcy trustee in trying to substantiate what is true and what is not. If the loan was obtained under the use of fraud, then it would not be dischargable in the bankruptcy code and it will stick to her as a criminal offense. Bankruptcy chapter 7 then would “not erase” this debt.

Me being a mortgage lender, I recognize the flags.

Incredibly, one of Cathy Shaughnessy’s campaign brochures bears this headline, “Who Will Protect Our Home Values in West Bloomfield?” Hmmm . . . not that a Township Clerk’s job has anything to do with protecting home values, but clearly a candidate who engaged in apparent mortgage fraud and then blew off her mortgage and had her house foreclosed upon while she gave thousands to her campaign, ain’t exactly the best choice to “Protect Our Home Values.”

Yes, there are a lot of red flags in the Cathy Shaughnessy odyssey. Sadly, there is only one candidate running for the office she seeks: her.

Tags: bankrupt, bankruptcy, bankruptcy fraud, campaign finance, campaign finance fraud, Catherine Caya Shaughnessy, Cathy Shaughnessy, Democrat, loan, mortgage fraud, West Bloomfield, West Bloomfield Clerk, West Bloomfield Township, West Bloomfield Township Clerk

What a completely disgraceful and disgusting woman! Obviously she has no shame.

Blanco on October 22, 2008 at 1:57 pm