November 17, 2010, - 1:43 pm

3 Charged in Islamic/Sharia-Complaint Ponzi Scheme (Incl. Obama Donor)

I’ve told you sooooo many times before that “sharia-compliant” mortgages and other investments are phony. As I’ve noted, interest is still paid, no matter how you get around it, no matter how it’s structured. Any Muslim or bank in America who tells you otherwise is committing fraud. It’s a fiction that Muslims pretend they are not paying interest when they use land contracts (that’s essentially what sharia mortgages are) to buy their homes. (Aside from that, as with most things in Islam, the idea of not charging or paying interest is stolen from Judaism. But Judaism long ago got rid of practicing most of these rules regarding interest, because Jews function as a modern religion, rather than one which insists on squatting toilets from the Sixth Century.)

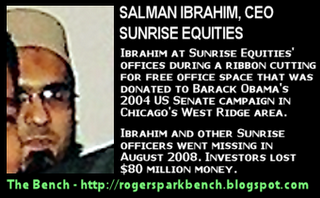

Barack Obama’s Muslim Buddy Salman Ibrahim Indicted for Cheating Fellow Extremist Muslims

And, now, there’s even more proof that sharia-compliant investments are literally a scam:

Three owners of a Chicago-based real estate development firm have been charged with fraud for allegedly cheating investors out of $43 million while claiming to be compliant with Islamic law.

A federal grand jury returned a 14-count indictment against the owners of Sunrise Equities on Tuesday, U.S. Attorney Patrick Fitzgerald said in a Wednesday statement. Federal officials said Salman Ibrahim, the majority owner and president of the now-bankrupt firm, and Mohammad Akbar Zahid, senior vice president of investor relations and a 10-percent owner, told clients that their investments would comply with Shariah law.

Islamic law prohibits interest, so Ibrahim and Zahid told investors they would receive monthly pay-outs of profits from real estate development. According to Fitzgerald’s office, the men promised annual returns of between 15 and 30 percent.

Federal officials said the three owners actually operated a Ponzi scheme between January 2003 and September 2008, selling promissory notes and using the proceeds to make fake profit payments to earlier investors. The men are accused of cheating hundreds of individual investors as well as making false statements to get loans from Mutual Bank, Cole Taylor Bank and Devon Bank. They allegedly misused investors’ funds, operating projects unrelated to real estate that were not disclosed to clients, and spending money on themselves.

Robert Grant, special agent-in-charge of the Federal Bureau of Investigation’s Chicago office, said this case marks the first time in the city “that an alleged fraud scheme has been uncovered that used a pillar of Islam” as a lure.

Uh, you keep telling yourself that, Agent Grant. It’s just the first time they got indicted for it. Anyone who believes in promises, especially in this economy, guaranteeing 15-30 percent returns on investment is a moron who deserves to be had. The thing is, Muslims cheat fellow Muslims all the time. They think nothing of cheating their Muslim brothers and sisters and can’t trust each other. That’s why they can’t expect the rest of us–who are not Muslims–to trust them. (The same rule applies to any peace treaties and land giveaways to Muslims, including and especially in Israel.)

Also indicted in the scam was Amjed Mahmood. I shed no tears for the “victims,” er . . . Islamo-suckers here. They were all Pakistani Muslims (read: extremists), whose greed got the best of them. So sad, too bad. Less money for Pakistani Muslim immigrant extremists means less money they have to give to extremist mosques, Islamic schools, HAMAS, Hezbollah, the Taliban, etc.

The only thing sad here is that our feds and resources are being used to sort out this fraud between cheating Muslims who took from the foolish, greedy Muslims who got taken. I’ll bet when these Mohamme-morons invested, they were probably told their 15-30% would come at the expense of the dumb American infidels. Since that’s known as “halal money” (permissible money under Islam, because it was scammed from non-Muslims–the most blessed form of Islamic income), that’s probably why they eagerly took the Islamo-bait.

I checked, and one of the men, Salman Ibrahim, filed for bankruptcy in Illinois in 2008. He’s also an Obama buddy and benefactor, according to Chicago News Bench (thanks to reader Duane for that tip), which also says Ibrahim has vanished from the U.S. (the Justice Dept. confirms that he’s fled the country and is now a fugitive). Why am I not surprised? Read the whole Justice Department press release and further details here. Ibrahim gave $2,000 to Barack Obama.

Since such devout Muslims like this are usually such big fans of sharia, including investments, why don’t they use their own sharia courts to decide the case instead of clogging our court systems with their tribal feuds and scams? Interesting how Muslims pick and choose when it’s a good time to tell on fellow Muslims to us American infidels.

Western Muslim Rule: When fellow Muslims are about to cheat infidels or, worse, commit terrorist attacks on them, it’s a sin to tell on other Muslims to non-Muslims. But when fellow Muslims take your money because you were a greedy fool, then it’s an emergency of the highest order that requires the infidel oppressors and evil Zionist pig/Great Satanists to be enlisted on your behalf.

“Religion of Peace” . . . and scamming each other while they also scam us. Halal money, baby!

Tags: Amjed Mahmood, Barack Obama, Chicago, donor, FBI, fugitive, greedy, Illinois, Indicted, indictment, investments, Islam, Mohammad Akbar Zahid, Muslim, Muslim Madoff, Muslim Ponzi Scheme, Muslims cheating Muslims, Pakistan, Pakistani, Pakistani Muslims, Robert Grant, Salman Ibrahim, Shari, Sharia Ponzi Scheme, sharia-compliant, Sunrise Equities

The notion of interest-free loans in Islam is a scam… like everything else.

How do they make money if they don’t charge interest? They do when no one’s looking and let people think they’re better than any one else.

Until the fraud is exposed. Halal money all the way indeed, baby!

NormanF on November 17, 2010 at 1:57 pm