February 16, 2010, - 3:40 pm

Your Day in Dubai Deadbeatism: Muslim Emirate Stiffs Investors 40%

**** SCROLL DOWN FOR UPDATE ****

Not only does the Muslim emirate of Dubai hate Jews (who–if they have an Israeli passport or stamp on one–are refused entry into the country a/k/a travel apartheid), it hates paying investors back. So, it’s stiffing them.

Laughing All the Way AT the Bank:

Sheikh Mohammad Bin Rashid Al-Maktoum, Dubai Ruler & Best Buddies

Yup, while the ruler and Princes of Dubai, the Al-Maktoum brothers, continue to live high on the hog (and mercilessly torture people just ‘cuz and get away with it), they refuse to pay back those from whom they borrowed. In fact the Princes’ government-owned Dubai World has announced it will only repay 60 cents for every dollar owed to creditors, including dhimmi Dubai investors HSBC Holdings, Royal Bank of Scotland Group, and Standard Chartered. Wow, I’d love to get $22 billion in cold, hard cash and only have to give back $13 billion. That’s a great deal.

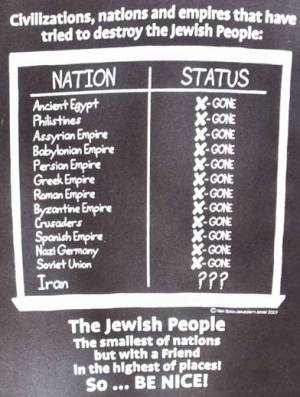

And, unfortunately for them, these Islamo-pandering, shawarmeh-nosed lenders will probably have to take what these jet-setting, Jew-hating, anti-Israel Sheikhs give them, lest they get even less . . . or nothing. And on top of that, they have to wait seven years to get paid. Incredible. That’s what happens when you invest with anti-Semites. You get burned. G-d works in mysterious ways, suckers.

Is Dubai Next . . . or Just Its Dhimmi Lenders?

For Dubai World’s creditors, indignity piles upon indignity. News that the troubled state-controlled conglomerate plans to repay its lenders a meager 60 cents for every U.S. dollar they are owed is yet another blow for lenders who, until four months ago, assumed Dubai World’s debts came with an implicit sovereign guarantee.

Dubai World is seeking to reschedule $22 billion of debt. But while the banks may be furious, they have such a weak negotiating hand that they may have to settle for little more than what is on the table.

Good thing Bush lost on having Dubai World run our major American ports, huh?

True, the offer doesn’t look too bad at first glance. But the banks will receive payment only after seven years and will get no interim coupon, a much bigger “haircut” than they had expected.

An alternative offer, that creditors receive payment in full after seven years but receive no government guarantee and accept 40% in the form of assets in Dubai World’s most troubled business unit, Nakheel, is no alternative at all, given the near impossibility of valuing Nakheel’s island developments.

Meanwhile, appeals to Dubai not to jeopardize its long-term reputation with investors likely are to fall on deaf ears. Abu Dhabi, which already has pumped $20 billion indirectly into Dubai, is calling the shots now. And now that Dubai has the support of the world’s fifth-largest holder of oil reserves and the Middle East’s largest sovereign-wealth fund, it may be less concerned over its standing with international banks than maintaining the support of its neighbor.

The banks may be seething, but this is one indignity they may choose to suffer in silence.

And even if the banks wanted to play hardball–the way they do with the little people who don’t hold the inflated Islamic title of Sheikh–it’s not really an option:

The banks could take the nuclear option and reject a deal, forcing Dubai to either default or again go cap in hand to Abu Dhabi. But many creditors have a substantial commercial presence in the United Arab Emirates. Dubai’s rulers could make operating in the emirate tough for any bank playing hardball.

Meanwhile, the U.S. makes it very easy for the Dubai deadbeats to play hardball over here.

I’m not the first to say it: you simply can’t trust these people. The Khoreishi Tribe learned the hard way, and so did the Jews who built Medina for Mohammed.

Dubai . . . they can build the tallest building in the world, but they can’t pay their bills.

**** UPDATE: Reader Sheldon writes:

Thanks for posting the Dubai-scheisters story.

What is particularly ironic is that the Dubai “govt” (read Muslim loons)

severely punishes those residents, citizens and visitors who dared fall behind on their debts on any property owned in the emirate.The punishments are apparently severe enough for hundreds if not thousands of deadbeats to escape on a plane leaving all their possessions behind and even leaving their uber-luxury cars and SUV’s abandoned in the Dubai airport parking lot.

Maybe the Financial World should insist that the “leaders” of Dubai be subject to own laws.

I’d love to see them rotting behind bars.

Ahhh, just desserts……..

Luv Ya

Shel

If only, Sheldon. If only.

Tags: $22 billion, 60 %, 60 cents, 60 percent, Al Maktoum, Anti-Israel, anti-Semitic, banks, bills, creditors, debt, debtor, Dhimmi, dhimmis, Dubai, Dubai Deadbeatism, Dubai deadbeats, Dubai World, emirate, haircut, House Committee on Standards of Official Conduct, HSBC Holdings, investors, Islam, Israel, Jew-hating, Jews, lenders, Muslim, Nakheel, Royal Bank of Scotland, Royal Bank of Scotland Group, seven years, Sheikh Mohammad Bin Rashid Al-Maktoum, sixty percent, Standard Chartered

Superb post, Debs. Fiscal justice is indeed served to the treacly islamo-panderers/

DS_ROCKS! on February 16, 2010 at 4:34 pm