January 12, 2010, - 12:14 pm

HA! Life Imitates Art: OJ Market Awakens a la “Trading Places”

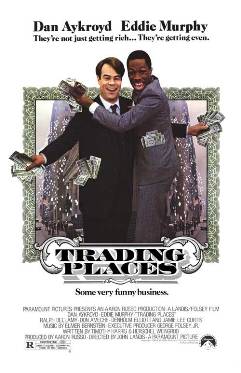

Remember “Trading Places,” the 1983 movie starring Eddie Murphy and Dan Ackroyd as, respectively, a homeless man and a rich guy who are forced into opposite stations in life after two old wealthy men (Don Ameche and Ralph Bellamy as the Duke Brothers) make a bet? A big part of the plot centers on trading orange juice futures, betting on whether or not the price of orange juice goes up or down, based on a secret insider report. It’s one of my favorite movies.

(“Global Cooling” Photo of Florida Orange w/Icicles from Rev. Dr. Sam Sewell)

Well, now, with the coldest temperatures to hit Florida in years, and orange crops faltering under icicles and frost, the orange juice market has re-awakened, just like in the movie.

Orange juice futures trader Dominick Minervini spent years fending off comparisons to Dan Aykroyd in “Trading Places,” the 1983 movie that thrust the tiny market into the public consciousness.

“If I said I trade orange juice, everybody would say, ‘Oh, it’s just like the movie,’ ” said Mr. Minervini, who has been trading for more than two decades.

But while most days in orange juice trading are a far cry from the movie’s iconic scenes of double dealing and frenzied trading—for one thing, all futures trading is now electronic—the past few days have seemed eerily similar.

From “Trading Places”: Dan Ackroyd Explains the Frozen Orange Juice Concentrate Market . . .

As an arctic chill spread across the main growing regions of Florida, orange juice prices began a wild ride. After soaring 7% on Friday, they plunged on Monday to finish down 19.3 cents, or 13%, at $1.3185 a pound, causing big profits for some and losses for others. Early Monday morning, as crop damage appeared to be less than feared, prices dropped as much as 20 cents, their exchange-imposed daily limit. Prices quickly moved back up to trade down less than five cents, before again heading lower.

“It’s scarier than anything. It’s like the Wild West,” said Mr. Minervini, who once was a trader on the floor of the commodities exchange but now trades from his New Jersey home. On Monday, Mr. Minervini traded 70 contracts of orange juice, a big day for him, and made about $8,000. “It’s not a bad day,” he said. . . .

In “Trading Places,” Mr. Aykroyd’s Louis Winthorpe III and Eddie Murphy’s Billy Ray Valentine join forces to get even with Mortimer and Randolph Duke, thwarting their attempt to corner the orange juice market and leaving them bankrupt. The climactic final scenes show frantic traders screaming out orders on the floor of the exchange, seeking to halt their losses.

But since 2008, frozen orange juice futures contracts have been traded electronically. Each futures contract represents 15,000 pounds of frozen concentrated juice, or about $20,000 in value based on Monday’s closing prices. Traders like Mr. Minervini, who once jostled in the New York Board of Trade trading pit, now sit behind a screen, placing orders with the click of a mouse, from anywhere in the world. . . .

But juice brokers and growers often just use the market as a gauge of price direction, rather than trading directly on the exchange. Webb Tanner, president of Food Partners Inc., a juice broker in Florida, said he monitors futures prices every day and uses it as a pricing mechanism. But he doesn’t trade the futures markets. “You don’t have an extremely liquid and deep market like many other commodities,” Mr. Tanner said. Instead, the company sets prices as juice is delivered.

Orange juice futures began trading in 1967, 20 years after the invention of frozen concentrate.

Yup, life imitates art, yet again.

Tags: Billy Ray Valentine, Dan Ackroyd, Dominick Minervini, Don Ameche, Eddie Murphy, futures, Life Imitates Art, Louis Winthorpe III, market, Mortimer Duke, Orange Juice, Orange Juice Market, Ralph Bellamy, Randolph Duke, Trading Places

The arctic chill in Florida is really caused by global warming.

Little Al on January 12, 2010 at 12:39 pm